GETTING A MORTGAGE WITH CRIMINAL CONVICTIONS

WANT TO GET A MORTGAGE BUT YOU HAVE A CRIMINAL CONVICTION?

Unfortunately, when you have unspent criminal convictions, this is not always easy. Now, in the aftermath of the ‘credit crunch’ (mainly caused by irresponsible lending) and with unpredictable property prices, obtaining a mortgage is tougher than ever. Having a conviction only makes that harder.

So once you find yourself in a suitable position of financial security, the last thing you want is to have your past mistakes dragging you back down.

UNLOCK: THE CHARITY FOR PEOPLE WITH CONVICTIONS

Just like when you are looking for home insurance, ‘unspent’ convictions have to be disclosed to banks, building societies and mortgage lenders, if asked. If your conviction is ‘spent’, however, then you do not need to disclose it.

This is where Unlock might be able to help you. Confidentially log on to their online Disclosure calculator to easily work out whether your convictions are spent or unspent.

Most mortgages now require you to have buildings insurance in place as a term of the loan anyway. So it is important that you get the right mortgage and insurance for your needs. Mortgage lenders will typically check your credit score, verify your income and check where you have been living. So if you have spent time in prison, then they are likely to find out about your conviction. Make sure that you do not do yourself a disservice by concealing the fact that you have an unspent conviction; declare it upfront, if asked.

If your convictions have become spent because you were under 18 at the time of conviction, then you will not have to declare a prison address if it would lead to revealing a spent conviction.

DISCLOSING YOUR CONVICTION TO SECURE A MORTGAGE

The mortgage lender may well ask about convictions as part of their due diligence. If they do, you are duty bound to answer truthfully. Remember, the law states that you need only disclose unspent convictions.

Be ware that if you fail to disclose an unspent conviction and it is later discovered that you lied and concealed it, then you could be at risk of a further conviction. If your mortgage lender discovers this then your buildings insurance would also be affected, or more likely, invalidated.

LENDING CRITERIA FOR MORTGAGE BROKERS

Most mortgage companies set ‘Lending Criteria’ for intermediary brokers to follow, designed to help them determine whether a mortgage provider would accept your application. These criteria vary between providers but in most cases lenders will do a credit check to look for poor credit history or issues relating to financial crimes, like fraud. The type of crime for which you were convicted can therefore impact your chances of securing a mortgage.

GETTING INSURANCE WITH CRIMINAL CONVICTIONS

Once you have found a mortgage lender that is prepared to take you on, one requirement of your agreement will include gaining adequate home insurance with convictions. Criminal convictions can hold you back in this area as well, as many insurers will perceive an ex-offender as too high a risk.

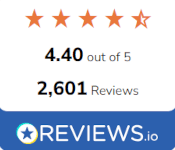

With Homeprotect you can obtain an online quote for buildings insurance, even with unspent convictions. We work closely with the registered charity Unlock to ensure that ex-offenders have access to the insurance they need at a fair price.