home insurance

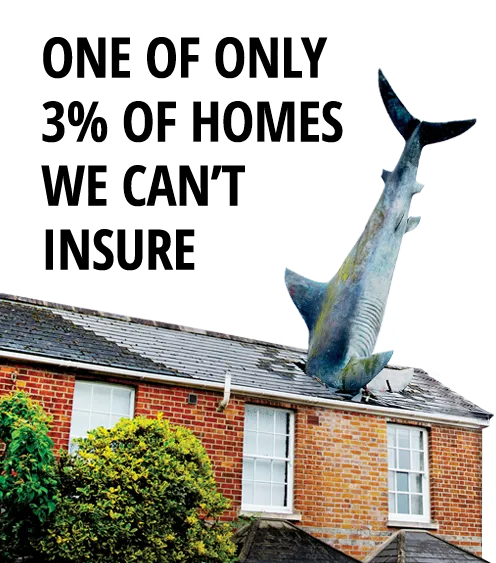

Cover for almost every home

- We can insure 97% of UK homes*.

- Policies underwritten by AXA Insurance

- Average quote time is only 10 minutes*.

Why Choose HomeProtect

- Policies underwritten by AXA Insurance

- 5 Star Rated by Moneyfacts

- Buildings Insurance Rated 5 Star by Defaqto for the eighth consecutive year

- Rated Excellent on Trustpilot from 16,000+ reviews

- Basic Legal Expenses and Home Emergency included as standard

Trustpilot Testimonials

Home Insurance for almost every home

Policy booklet

View and download key documents. The policy booklets which set out all the general terms and conditions.

faqs

Looking for help? Select a category to find answers to some of our most asked questions.

contact us

We’re here to help. Home insurance can be a lot to think about. You’re bound to have questions.