Probate House Insurance

Quick to buy online

- Used by executors, administrators and solicitors.

- Covers unoccupied and for-sale properties.

- Underwritten by AXA Insurance.

More information

Buying probate house insurance

When a loved one passes away and their property is granted probate, it’s important to make sure the deceased’s estate is well cared for. As each case is unique, it can be a fairly lengthy legal process to get all the documentation in order, which can lead to the property remaining empty for long periods of time.

With Homeprotect, you can get a quick quote for probate house insurance cover, as well as information on how to maintain the property in the meantime.

If you’d like to learn more about the probate process before purchasing probate house insurance, you can check out our probate guide: What is probate and how does it work?

probate house insurance and property inspections

It’s often recommended, and part of the policy terms, that a house in probate is inspected regularly.

While probate is being granted, it is up to the executors to secure the building. Even homes in a good state of repair can quickly degrade. Vacant properties are also targeted by criminals, so keeping the property safe by installing burglar alarms or changing the locks can be another unforeseen expense.

By taking steps to prevent break-ins, your insurance provider can give you a competitive quote for probate house insurance.

Unoccupied house insurance during probate

Taking all the risks of an empty house into account, when an insurance provider is contacted to insure the estate during probate, they will need to verify that the customer has an ‘insurable interest’ in the property in order to provide cover. Once confirmed, the policy will usually be issued in the name of the executor with any beneficiaries named as additional policyholders.

The final point those seeking probate house insurance need to be aware of is how long the property will be unoccupied. At Homeprotect, we can provide unoccupied property insurance for executors if the property is left unoccupied for more than 30 days.

Our probate house insurance can (unless the property is unoccupied) cover you against incidents of theft, vandalism, flooding and many other scenarios. Just let us know what your current state of affairs is in relation to the property, either online or by phone, and we will take care of the rest.

“If you are an executor responsible for protecting a loved one’s property, then a Homeprotect home insurance policy may suit your needs. Our Buildings insurance is Defaqto 5 Star-rated, although do bear in mind that if the property is unoccupied during the probate process then cover is limited to incidents such as fire and liability to the public or domestic staff.”

– Gerry McNally, Home Insurance Expert

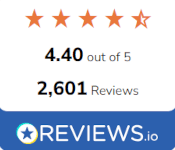

Unoccupied House Insurance Reviews

Get a home insurance quote online

Get a quote online in less than 10 minutes*

What’s covered by UNOCCUPIED HOME insurance?

Unoccupied home insurance cover varies depending on whether the property is empty on a short term of long term basis.

Short term unoccupancy

If the property is usually occupied but is left unoccupied for between 31 and 180 days, then you typically get all the cover of our standard policy terms, but with exception of certain exclusions, see what is and isn’t covered below:

What’s included?

Quick home emergency response times

Have a home emergency, such as electricity failure, faulty locks or vermin infestation? With the 24/7 Home Emergency cover, which we provide as standard, you can typically get an engineer at your home within four hours. And if you’re worried about an uncontrollable leak in your home, we aim to have an emergency plumber to you within two hours.

Extreme weather conditions may extend response time. Policy terms and claim limits apply.

5 star rated buildings cover

Our building insurance has been given the highest rating by independent financial research companies, Defaqto and Moneyfacts.

Repair guarantee

Any buildings work we undertake is guaranteed for 24 months following a claim and any contents repair work we undertake is guaranteed for 12 months.

New for old

Where we replace an item, we will do our best to meet the original specification on a ‘new for old’ basis. If we can’t find an exact replacement, we’ll offer you a suitable alternative, or a full cash settlement.

Legal advice

We provide Legal Protection cover as standard, giving you access to telephone legal advice on any personal legal issue, under the laws of the UK, any European Union country, the Isle of Man, Channel Islands, Switzerland and Norway.

What isn’t included?

Escape of water incidents during the period: 1 October – 1 April (inclusive).

Theft incidents, unless all security features (e.g. locks and alarms) included in your property are maintained in good working order and in full operation.

Claims involving money and high risk items (e.g. jewellery).

Damage cause gradually, or by wear and tear, or by failure to fix a known issue.

Faulty design or poor workmanship.

Damage caused by pets.

The cost of repairing or replacing items following a mechanical or electrical fault.

Lost items.

Long term unoccupancy

If the property is not usually occupied, or is left unoccupied for more than 180 days, there are two levels of cover. Basic cover is available online. Extended cover is available over the phone, via referral to our underwriting team. The following table compares what sort of insured events are covered:

| Insured loss | Basic cover (available online) | Extended cover (call for quote) |

|---|---|---|

| Fire, Lightning, Earthquake, Explosion, Aircraft or other flying devices (FLEEA) | ✔ | ✔ |

| Liability to the public | ✔ | ✔ |

| Escape of Water or oil | ✖ | ✖ |

| Accidental damage | ✖ | ✖ |

| Storm or flood | ✖ | ✔ |

| Subsidence or tree roots | ✖ | ✔ |

| Theft (including attempted theft) | ✖ | ✔ |

| Malicious damage | ✖ | ✔ |

| Collisions with wild animals or vehicles | ✖ | ✔ |

| Aerials & falling objects | ✖ | ✔ |

| Damage by emergency services | ✖ | ✔ |

Looking for more cover? Give us a call on 0330 660 1000 to talk to our team about extended cover.

UNOCCUPIED HOME Insurance Cover Levels

The following cover levels apply for both short and long-term unoccupancy:

Buildings cover

Covers the main structure of your home if you need to rebuild or repair it.

up to £1 million

(eligibility criteria applies)

Contents cover

Covering the value of all your possessions in the home, on a new for old basis.

from £25,000

Home emergency

Covers emergencies that occur in your home like uncontrollable water leaks, electricity failure, faulty locks and vermin infestation. Two levels of cover are available.

up to £500

Family legal protection

Provides a 24/7 legal advice helpline and up to £25,000 cover for claims involving contract disputes and property damage. For a claim to be successful, there must be reasonable prospects (more than a 50% chance) of winning the legal case. Two levels of cover are available.

up to £25,000

Outbuildings cover

Covers rebuild or repair of your outbuildings (such as detached garages, greenhouses, sheds and summerhouses).

from £20,000

Liability cover

Liability cover involving accidental death, bodily injury or illness or property damage that you are legally liable to pay.

up to £5 million

New Customer?

If you’re deciding on whether to buy home insurance with us, you can use our latest policy booklets as a guide.

Existing Customer?

Find answers to some of your questions here. Your latest policy documents are also available to view and download.

Your probate Questions Answered

If you’re handling the affairs of an estate of someone who has passed away, you need to get “grant of probate” before you have the authority as the “executor” to distribute the assets from the estate, as per the deceased’s will.

When a person passes away and their property is left as an inheritance, it is owned by the beneficiary. If there are multiple beneficiaries, then they are co-owners of the property. It is the beneficiary’s responsibility to make sure that the appropriate probate home insurance is in place. For instance, while in probate the building should be protected by unoccupied house insurance.

The cost of probate house insurance will vary depending on factors such as location, rebuild value, property security, property maintenance, and the level of cover you choose.

You can get a quote for probate house insurance today.

You will need to prove you have an ‘insurable interest’ in the property for Homeprotect to provide cover. Once confirmed, the probate home insurance policy will usually be issued in the name of the executor with any beneficiaries named as additional policyholders.

Yes, you need a valuation for probate. Check our Valuing Property for Probate page to learn more about the process.

Probate courts administer the distribution of a deceased person’s assets. This can include selling their property; this is called liquidating the deceased’s assets. The sale of the house is therefore subject to probate law, and buyers may need to attend court to confirm the sale.

After a person passes away and their property is in probate, it needs to be valued. This can often mean that the house is left empty for some time, and in this case it should be protected by unoccupied home insurance for probate. The beneficiary is responsible for ensuring that the right level of cover is in place.

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.