Building Insurance

Quick to buy online

- Specify the rebuild cost you need.

- Cover for homeowners and landlords.

- Underwritten by AXA Insurance.

- Average quote time is only 10 minutes.

More information

Providing you with excellent levels of insurance cover to protect your residential building

Buildings insurance covers not only the main building but also things such as interior decorations, fixtures and fittings (e.g. carpets), garages, domestic outbuildings, drives, patios, gates, walls, swimming pools and tennis courts within the boundary of the property.

Homeprotect can provide buildings insurance for homes that are classed as “hard to insure” by others, such as listed buildings, steel framed buildings or those near water. Find out more about the different property types and situations that we can cover.

Cover up to £1 million

Normally a Homeprotect buildings insurance policy provides up to £1 million to rebuild your buildings, although more is available if your property needs it. We recommend that you check how much your property would cost to rebuild before getting a quote, avoiding the complications and disappointment of under-insurance in the event of a claim.

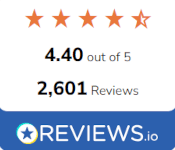

specialist Home Insurance Reviews

Get a home insurance quote online

Get a quote online in less than 10 minutes*

What’s covered by buildings insurance?

Having buildings insurance means you won’t be out of pocket if you need to repair or rebuild your home if it’s been damaged or destroyed.

What we offer

Quick fix for uncontrollable leaks

Have a home emergency, such as electricity failure, faulty locks or vermin infestation? With the 24/7 Home Emergency cover, which we provide as standard, you can typically get an engineer at your home within four hours. And if you’re worried about an uncontrollable leak in your home, we aim to have an emergency plumber to you within two hours.

Extreme weather conditions may extend response time. Policy terms and claim limits apply.

5 star rated buildings cover

Our building insurance has been given the highest rating by independent financial research companies, Defaqto and Moneyfacts.

Repair guarantee

Any buildings work we undertake is guaranteed for 24 months following a claim.

Legal advice

We provide Legal Protection cover as standard, giving you access to telephone legal advice on any personal legal issue, under the laws of the UK, any European Union country, the Isle of Man, Channel Islands, Switzerland and Norway.

What isn’t included?

Damage cause gradually, or by wear and tear, or by failure to fix a known issue.

Faulty design or poor workmanship.

Damage or liability arising out of the activities of contractors.

BUILDINGS Insurance Cover Levels

Our buildings insurance is designed to protect your home against insured events such as fire, storm, flood, escape of water, theft, malicious damage, subsidence, landslip or heave.

Buildings cover

Covers the main structure of your home if you need to rebuild or repair it.

up to £1 million

(eligibility criteria applies)

Alternative accommodation

For you and your pets, in case you can’t live at your home while it’s being repaired after an insured event.

up to £75,000

Home emergency

Covers emergencies that occur in your home like uncontrollable water leaks, electricity failure, faulty locks and vermin infestation. Two levels of cover are available.

up to £500

Family legal protection

Provides a 24/7 legal advice helpline and up to £25,000 cover for claims involving contract disputes and property damage. For a claim to be successful, there must be reasonable prospects (more than a 50% chance) of winning the legal case. Two levels of cover are available.

up to £25,000

Trace and access

Covers the cost of detecting the source of a water or oil leak and repairing any damage caused in the process.

up to £10,000

Outbuildings cover

Covers rebuild or repair of your outbuildings (such as detached garages, greenhouses, sheds and summerhouses).

from £20,000

Liability cover

Liability cover involving accidental death, bodily injury or illness or property damage that you are legally liable to pay.

up to £5 million

Accidental damage

Covers situations when unexpected accidents happen, such as spillages on the carpet, breakages around the house or drilling through hidden pipes. Two levels of cover are available.

Optional

POLICY DOCUMENTS

If you’re deciding on whether to buy home insurance with us, you can use our latest policy booklets as a guide.

Existing Customer?

Your latest policy documents are available to view and download.

Your Questions Answered

Buildings insurance covers the structure of the home together with its fixtures and fittings: it covers the cost of repair or rebuilding after fire or weather damage for instance. Contents insurance covers the contents of your home, the possessions you would take with you if you moved house.

Buildings insurance is a policy that protects the structural aspects of a property, such as the walls, roof, fixtures and fittings against loss or damage. Buildings insurance will cover the rebuild cost of your home; this is not the same as the property’s market value.

Yes. All domestic garages, outbuildings, sheds, extensions and conservatories fall under the definition of Buildings and are covered by your Buildings insurance. Please check that the level of cover included in the policy is enough to rebuild all your outbuildings.

If you own the freehold of your flat, you should take out buildings insurance. If you live in a leasehold flat, or are a tenant, your landlord has responsibility for sourcing buildings insurance.

When you purchased the property a homebuyer’s survey is likely to have included the date of construction.

Alternatively, your local authority may have a record of when planning permission was granted to build the property. Your neighbours may also have an idea of when the property was built.

Note: A rough estimate of the property construction date is enough for the purposes of getting your home insurance quote.

If you have a heritage property, here are some steps to take:

- Search for your property for free in the 1862 Act register on Land Registry’s digital archives.

- Look at the architectural style and features of the house, particularly the roof and windows.

- Check your county record offices, local parish records or ask to view local archives at your library.

- Look for old copies of Ordnance Survey maps for your area (local library).

- Google for a local historian or a historical society and contact them to see if they can help you.

- Look at census data between 1841 and 1911 to find the first year that the address was mentioned.

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.