Home Insurance with a Claims History

Quick to buy online

- We cover customers that other companies won’t.

- Underwritten by AXA Insurance.

- Cover considered even if you have high number of previous claims.

More information

Made claims in the past? Get a quote today

If you have made a lot of insurance claims, or one very big one, there is a good chance that your current insurer will take steps to refuse your renewal or raise the price of your premium to deter you from renewing.

When you apply for home insurance you need to tell the insurer about any previous claims as it could affect the assessment of risk. Though many insurance providers will be discouraged by such information, Homeprotect will always consider you.

Like other insurance companies, we ask that you are honest with us but we won’t refuse to quote you because of your adverse insurance history. Please note that we’re unable to provide a quote if you have a claim that is still outstanding with another insurance company.

To get an online quote, you’ll need to know:

- Details about previous claims: the year, value and type of claim.

- Rebuild cost of the property.

- Approximate year that the property was built.

- Whether the property has suffered from a flood, structural movement, subsidence and whether it has been underpinned.

- You or someone you live with has a criminal conviction.

- Types of locks fitted to the external doors.

- Total value of all your belongings if replaced new.

- List of your bicycles, tablets, mobile phones, laptops and other high risk or high value belongings.

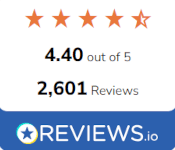

specialist Home Insurance Reviews

Get a home insurance quote online

Get a quote online in less than 10 minutes*

What’s covered by BUILDINGS & contents insurance?

Home insurance provides financial protection if you need to repair your home or replace your belongings after they’ve been stolen, damaged or destroyed.

It comes in two parts: buildings insurance (cover against damage to the property itself) and contents insurance (for damaged or stolen items within the home). These can be combined or bought separately, so the first step is deciding which option is better for you.

What we offer

Quick home emergency response times

Have a home emergency, such as electricity failure, faulty locks or vermin infestation? With the 24/7 Home Emergency cover, which we provide as standard, you can typically get an engineer at your home within four hours. And if you’re worried about an uncontrollable leak in your home, we aim to have an emergency plumber to you within two hours.

Extreme weather conditions may extend response time. Policy terms and claim limits apply.

5 star rated buildings cover

Our building insurance has been given the highest rating by independent financial research companies, Defaqto and Moneyfacts.

Repair guarantee

Any buildings work we undertake is guaranteed for 24 months following a claim and any contents repair work we undertake is guaranteed for 12 months.

New for old

Where we replace an item, we will do our best to meet the original specification on a ‘new for old’ basis. If we can’t find an exact replacement, we’ll offer you a suitable alternative, or a full cash settlement.

Legal advice

We provide Legal Protection cover as standard, giving you access to telephone legal advice on any personal legal issue, under the laws of the UK, any European Union country, the Isle of Man, Channel Islands, Switzerland and Norway.

What isn’t included?

Damage cause gradually, or by wear and tear, or by failure to fix a known issue.

Faulty design or poor workmanship.

Damage caused by pets.

The cost of repairing or replacing items following a mechanical or electrical fault.

Lost items.

buildings & Contents Insurance Cover Levels

Our home insurance is designed to protect your home against insured events such as fire, storm, flood, escape of water, theft, malicious damage, subsidence, landslip or heave.

Buildings cover

Covers the main structure of your home if you need to rebuild or repair it.

up to £1 million

(eligibility criteria applies)

Contents cover

Covering the value of all your possessions in the home, on a new for old basis.

from £25,000

Alternative accommodation

For you and your pets, in case you can’t live at your home while it’s being repaired after an insured event.

up to £85,000

Home emergency

Covers emergencies that occur in your home like uncontrollable water leaks, electricity failure, faulty locks and vermin infestation. Two levels of cover are available.

up to £500

Family legal protection

Provides a 24/7 legal advice helpline and up to £25,000 cover for claims involving contract disputes and property damage. For a claim to be successful, there must be reasonable prospects (more than a 50% chance) of winning the legal case. Two levels of cover are available.

up to £25,000

Trace and access

Covers the cost of detecting the source of a water or oil leak and repairing any damage caused in the process.

up to £10,000

Outbuildings cover

Covers rebuild or repair of your outbuildings (such as detached garages, greenhouses, sheds and summerhouses).

from £20,000

Liability cover

Liability cover involving accidental death, bodily injury or illness or property damage that you are legally liable to pay.

up to £5 million

Personal possessions

Cover for portable items that you take out of your home, like bags, clothes and sports equipment

Optional

Gadgets, bikes and valuables away from the home

Cover for electronic gadgets (e.g. mobile phones, laptops, tablets etc), bikes (including electrically assisted bikes) and valuables (e.g. watches and jewellery) that you take out of your home.

Optional

Accidental damage

Covers situations when unexpected accidents happen, such as spillages on the carpet, breakages around the house or drilling through hidden pipes. Two levels of cover are available.

Optional

New Customer?

If you’re deciding on whether to buy home insurance with us, you can use our latest policy booklets as a guide.

Existing Customer?

Find answers to some of your questions here. Your latest policy documents are also available to view and download.

Additional Cover Options

Accidental Damage

The Homeprotect policy includes the option of Basic Accidental Damage, which covers electrical home entertainment equipment (such as desktop computers and monitors, DVD and Blu-Ray players, gaming consoles, home cinema systems, sound systems and TVs) up to £1,500 per claim. An upgrade …

Legal expenses cover

The insurance policy includes Basic Legal Expenses cover which provides up to £25,000 for legal fees you may face for disputes associated with your home; such as ownership of the insured property; and the sale or purchase of the insured property. You can upgrade to Full Legal Expenses cover.

Home emergency cover

The insurance policy includes Basic Home Emergency cover which provides cover for common home emergencies including burst pipes; failure of the domestic power supply (gas or electricity); and removal of pests or vermin. You can upgrade to Full Home Emergency to include cover for roof …

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.