What is Probate & How Does it Work?

Losing someone close to us can be a sad and stressful experience. And alongside the emotional challenges, we’re often left wondering what to do with the person’s material possessions. Probate is a part of this process.

But what is probate?

In this article, Homeprotect answers this question and provides further advice on when probate is necessary, the associated costs and information on the potential insurance implications of the process.

What Is Probate?

Probate is the process of validating the estate and will of a deceased person. It involves identifying and confirming assets, paying off debts and taxes and distributing remaining assets to beneficiaries as requested in the will.

The probate court oversees this process and ensures the wishes of the deceased are met accurately – and that beneficiaries and creditors are properly addressed.

The duration and complexity of probate can differ depending on factors such as the size of the estate, the existence of a will and potential disputes among heirs.

Is Probate Always Necessary?

Probate isn’t always necessary to carry out the wishes of the deceased. Whether or not probate is required depends on multiple factors – from the nature and value of assets, the presence of a valid will and local laws regarding inheritance.

Sometimes, assets may pass outside of probate through methods like joint ownership, beneficiary designations or trusts.

Small estates with limited assets may qualify for simplified probate procedures or even exemptions.

It’s important to consult with legal advisors for more information about which avenue is best regarding your probate situation.

Can You Handle a Probate Process Without Professional Aid?

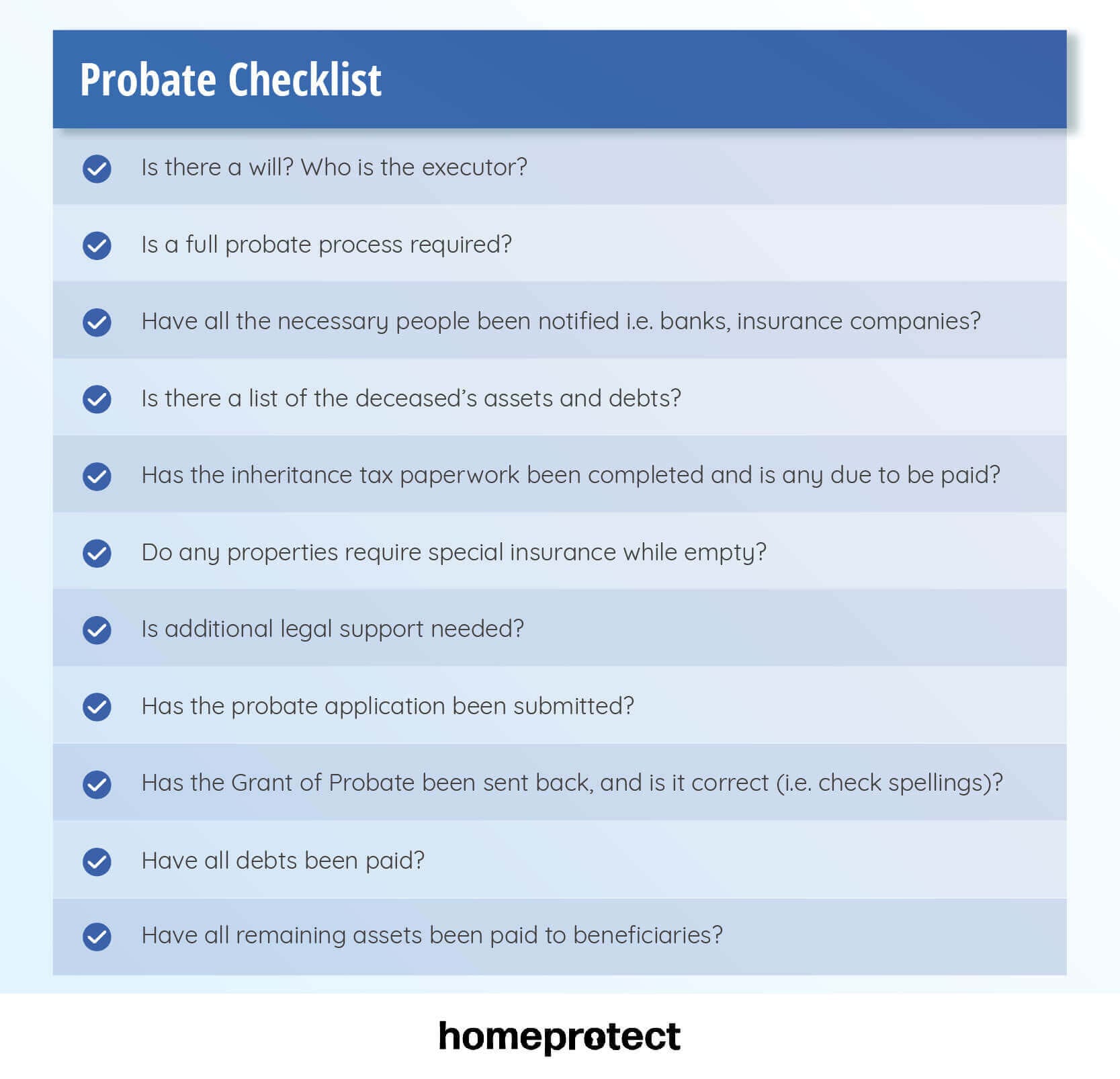

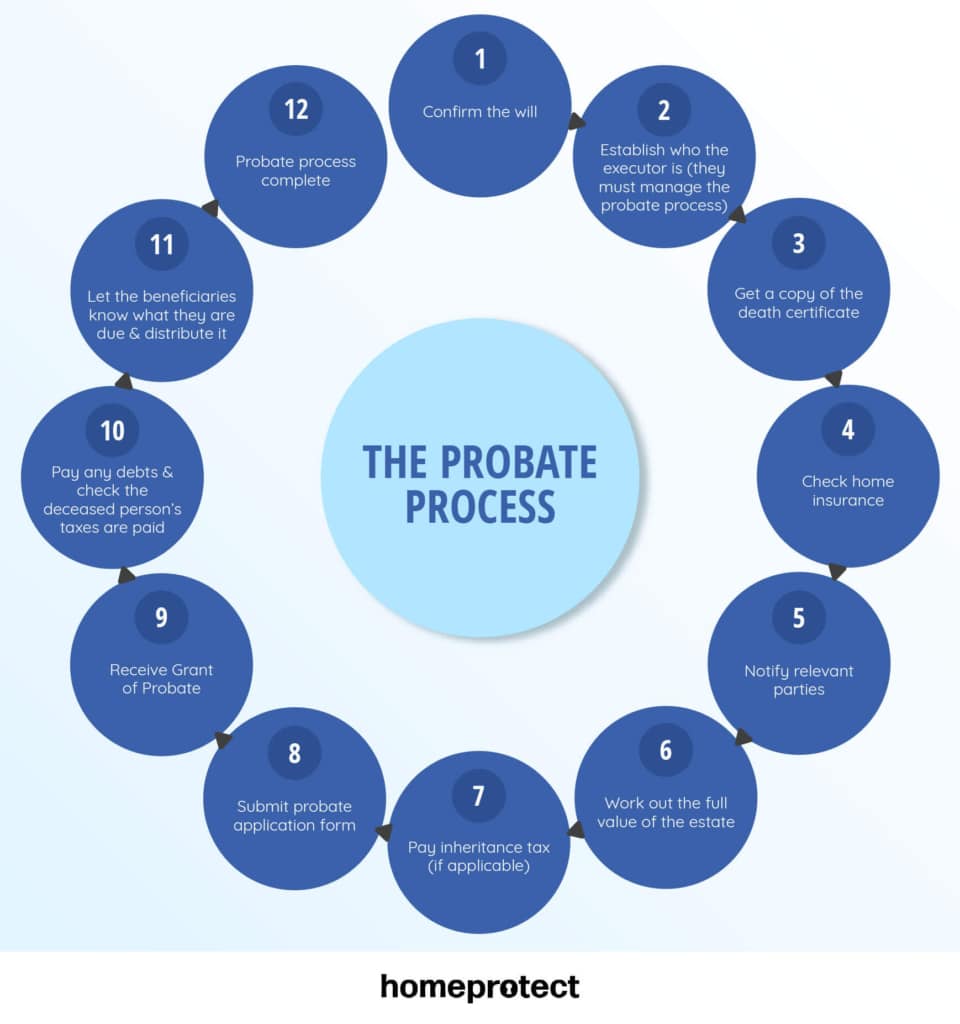

Handling probate without professional aid is possible, but it can be difficult, stressful and time-consuming. Here are the key steps to handling probate without professional assistance:

- Research & Understand Probate Laws: Familiarise yourself with laws governing probate in your country to ensure compliance.

- Gather Necessary Documents: Obtain the original will, death certificates and any other documents related to the deceased person’s assets, debts and beneficiaries.

- File Probate Documents: Prepare and file the necessary probate documents with the appropriate probate court.

- Notify Interested Parties: Notify any beneficiaries, creditors and other relevant parties as required by law.

- Inventory & Appraised Assets: Create an inventory of the deceased’s assets, and if necessary, obtain expert appraisals of more valuable assets. This includes valuing property for probate.

- Manage Debts & Expenses: Using available assets, pay off any outstanding debts and expenses of the estate.

- Distribute Assets: Distribute assets to beneficiaries following the will as a guide.

- File Final Tax Returns: Prepare and file the final income tax return and, if applicable, estate tax returns.

How Long Does the Probate Process Take?

The probate process can be prolonged, and the speed it takes to successfully complete probate can vary depending on the size and nature of assets. A rough estimate for a probate period with a moderate estate is around sixteen weeks.

However, if there are further verification milestones – or beneficiaries needing to submit information – it could take up to a year.

How Does Probate Differ With or Without a Will?

Probate can vary significantly depending on whether or not there is a will.

If there is a legal will, the probate process will typically involve validating its authenticity. This also involves appointing the executor or personal representative named in the will – and then distributing assets according to its instructions.

If there is no valid will, the probate process follows the laws of intestacy. The court appoints an administrator to handle the estate, and assets are distributed according to state laws governing inheritance.

These laws often prioritise spouses, children and other close relatives.

The presence of a will can streamline the probate process by providing clear instructions – while intestacy can introduce complexities when determining rightful heirs and asset distribution.

What Is an Executor of a Will?

Also known as a personal representative, the executor of a will is an individual appointed by the deceased to handle matters involving their estate.

This includes the distribution of assets according to the guidelines laid out in the will, as well as gathering those assets and managing any debts and taxes that need to be paid.

For example, an individual may appoint their first-born child as the executor of their will – who will be responsible for transferring inheritance money or physical heirlooms to relevant parties.

The executor has a fiduciary duty to act in the best interests of the estate, its beneficiaries, and the deceased’s last wishes. This results in the orderly settling of the deceased person’s financial affairs.

What If Probate Is Contested?

If probate is contested, it means someone has challenged the validity of the will or raised objections to the administration of the estate.

Contesting probate may lead to a legal dispute and may involve litigation.

When probate is contested, the court will review the evidence and arguments presented by all parties involved. The outcome could result in the will being upheld, modified or even declared invalid.

The probate process may then be delayed, and the final distribution of assets to beneficiaries may be postponed until the dispute is resolved.

If facing a contested probate situation, it’s important to contact a probate attorney or other legal professional.

What Are the Costs Associated with Probate?

There are many costs associated with probate. These can include court filing fees, attorney fees, executor fees, appraiser fees and accounting fees.

The costs can vary depending on the complexity of the estate, the size of the assets and any legal or professional assistance required.

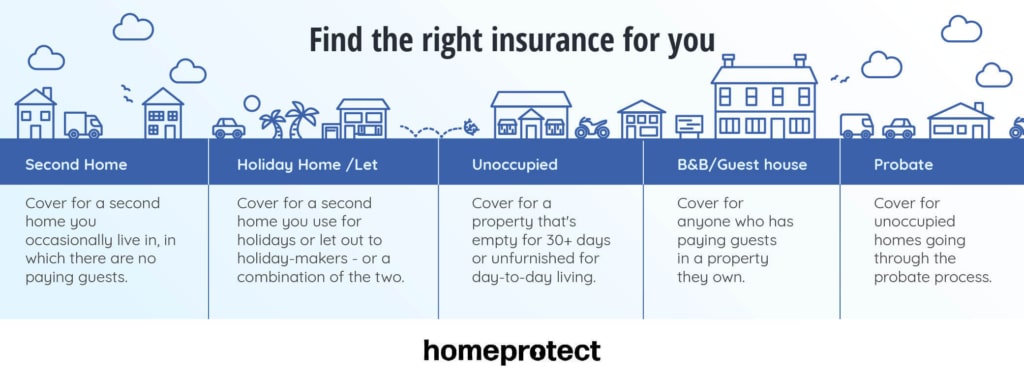

CAN YOU INSURE A HOME DURING PROBATE?

As long as you have an ‘insurable interest’ in the property, so for example you are the executor, we should be able to offer you a home insurance quote.

Homeprotect provides property probate insurance which can be purchased by executors and administrators. It covers both unoccupied and for-sale properties.

Get a home insurance quote online

Get a quote online in less than 10 minutes*

The Future of Probate

The future of probate is becoming increasingly digital, with evolving legal frameworks and technological advancements:

- Digital Assets: As more people possess digital assets such as cryptocurrencies, online accounts and digital media, effectively protecting and distributing these items has become increasingly important. Laws and regulations are evolving to include digital assets and it’s important any current probate process effectively deals with these assets.

- Streamlined Processes: Some areas are adopting streamlined probate processes to simplify and expedite the administration of smaller estates. This may involve relaxed requirements, alternative dispute resolution methods or increased use of technology for document filing and communication.

- Privacy Concerns: In an era of heightened privacy concerns, there may be a focus on balancing the need for transparency in probate proceedings. This includes protecting personal information and sensitive details concerning the deceased and their beneficiaries.

- Increased Automation: Technology can play a role in automating certain probate processes, such as asset valuation, document management, and beneficiary identification. This can enhance efficiency and reduce administrative burdens.

Your Questions Answered

Probate fees in the UK vary, but as of October 2025 if the estate is valued below £5,000 there is no fee, and if it’s above that amount the standard application fee is £300 – but it’s important to check the UK government website for the latest fees. Additional costs may include professional fees, such as a solicitor or probate specialist fees, which can vary depending on the complexity of the estate and the services required.

The probate court or similar judicial authority will decide whether an estate requires probate. The court examines relevant laws, values and complexity of the estate. They also examine any legal documents – including the will – to make this determination.

The amount of money required to trigger the probate process in the UK is £5,000. Below this amount, funds are generally released without a formal probate process.

When you receive probate – also known as a grant of probate – you gain legal authority to administer the deceased’s assets in line with the instructions laid out in their will. This also includes paying taxes and debts, managing disputes and ensuring the estate is handled by laws and regulations.