More information

Insuring a property that isn’t your main residence can be tricky. We can help!

Please be advised that we can only cover properties in the UK.

Second Home Insurance is specifically designed for properties that aren’t lived in all year-round. Unlike standard policies for primary residences, this will take into account circumstances that can affect a home that’s only used part-time. Second home insurance provides cover for a property you own but don’t live in most of the time. Whether it’s a holiday retreat, a rental property, or a weekday base, you’ll need cover that reflects the extra risks of not being there day to day.

We currently insure over 40,000 second homes in the UK, and you can get a quote to insure yours in minutes.

Do I need second home insurance?

Yes. If your second home is left unoccupied for long periods, it can be more vulnerable to theft, fire, water damage, or vandalism. That’s why it’s important to have both buildings and contents insurance in place to protect it.

Second home insurance can be appropriate for:

- Homes used as holiday lets or short-term rentals

- Homes undergoing probate or awaiting sale

- Properties used seasonally or as weekend homes

- Landlords between tenants

Second homes can be left empty for significant periods of time, and therefore face greater risks such as break-ins, or leaks that can go unnoticed for a while. In some cases, mortgage lenders will set specific requirements for insurance policies of these types of properties. Some insurers may not insure a second home at all, so you would need to check this with them directly. If they don’t, you may need a specialist provider like Homeprotect.

What counts as a second home?

Your second home is any property that isn’t your main residence. This means:

- It’s not your legal, financial, or voting address

- You don’t spend most of your time there

- Your main belongings are stored elsewhere

If your property is used for both personal use and letting, or left empty for extended periods, second home insurance ensures you’re covered.

Yes. If you rent your second home to paying guests, we offer specialist cover including:

– Loss of rent if your property can’t be used after an insured event

– Public liability to protect you if a guest is injured or their belongings are damaged

If you let to guests, keep in mind that we can’t offer:

– Accidental damage cover

– Cover for personal possessions, gadgets, bikes, or valuables away from the home

“Unoccupied” means nobody has lived in (i.e. regularly stayed overnight and carried out normal activities) for more than 30 consecutive days, or if the home is left unfurnished. If your property will be unoccupied for more than 30 days, you may be able to keep certain cover in place by arranging regular internal inspections (every 30 days) and keeping evidence – see the policy booklet for details.

If your property is left unoccupied for more than 30 consecutive days, your cover will remain active, but certain exclusions apply.

We won’t provide cover for:

– Escape of water claims between 1 October and 1 April (inclusive)

– Theft or attempted theft, unless all security features listed in your Statement of Fact are in good working order

– Jewellery and watches, unless stored in a locked safe with the keys removed

– Money, under any circumstances

To maintain cover during these short-term unoccupied periods, the property must be entered and internally inspected at least once every 30 days, with evidence available at point of claim.

If the property is left unoccupied for more than 180 days, additional restrictions will apply unless extended cover is approved.

specialist Home Insurance Reviews

Get a home insurance quote online

Get a quote online in less than 10 minutes*

What’s covered by SECOND HOME insurance?

Home insurance provides financial protection if you need to repair your home or replace your belongings after they’ve been stolen, damaged or destroyed.

It comes in two parts: buildings insurance (cover against damage to the property itself) and contents insurance (for damaged or stolen items within the home). These can be combined or bought separately, so the first step is deciding which option is better for you.

What we offer

Emergency help when you need it most

If you have a home emergency — such as a power outage, uncontrollable leak or a broken lock — our 24/7 Home Emergency cover is included as standard.

- We aim to get an engineer to you within four hours

- For serious water leaks, we’ll try to have a plumber with you in two hours

Response times may vary during extreme weather. Policy terms and claim limits apply.

Repair guarantee

We guarantee any buildings work we arrange after a claim for two years. Contents repairs are guaranteed for one year.

New for old

Where we replace a damaged or stolen item, we’ll do our best to match the original — on a ‘new for old’ basis. If that’s not possible, we’ll offer a suitable alternative or a full cash settlement.

Legal support when you need it

Family Legal Protection is included as standard. You’ll have access to expert telephone legal advice on personal matters under the laws of the UK and most of Europe.

What isn’t covered?

There are some things we can’t cover, including:

Gradual damage, wear and tear, or issues you knew about but didn’t fix

Faulty design, construction, or workmanship.

Theft, vandalism or accidental damage caused by a paying guest.

Mechanical or electrical faults

Escape of water incidents occurring between 1 October – 1 April (inclusive) if your home is left unoccupied for more than 30 consecutive days.

Alternative accommodation costs (if the property isn’t your main home)

Personal Possessions (e.g. bags, clothes, sports equipment used away from the home)

Gadgets, Bikes & Valuables Away from the Home (e.g. phones, tablets, watches, jewellery)

Keeping your home and belongings in good condition is essential. If damage happens because of neglect or poor maintenance, your claim may be declined, and your policy could be cancelled.

SECOND HOME Insurance Cover Levels

Our home insurance is designed to protect your home against insured events such as fire, storm, flood, escape of water, theft, malicious damage, subsidence, landslip or heave.

Buildings cover

Protects the main structure of your second home, including attached garages and conservatories, and permanent outdoor features such as patios, driveways and boundary walls.

up to £1 million

(eligibility criteria applies)

Contents cover

Protects your household contents — including furniture, clothing, appliances, gadgets and valuables — against insured events. Cover is provided on a new for old basis.

from £25,000

Loss of rent

If you have paying guests, we’ll cover lost rent if your guests can’t stay in the home due to an insured event.

up to £30,000

Home emergency

Covers sudden, unexpected emergencies — like an uncontrollable leak — that require immediate action to prevent damage or make your second home secure. Two levels of cover are available.

up to £500

Family legal protection

Covers legal costs for certain insured events. There must be a reasonable chance of success, and the incident must happen during your policy term. Two levels of cover are available.

up to £25,000

Trace and access

We’ll pay to detect the source of a water or oil leak, and cover the cost of reinstating floors, walls or paths that were disturbed in the process.

up to £10,000

Outbuildings cover

Covers detached garages, greenhouses, sheds, summerhouses and other outbuildings within your boundary or any communal area you’re legally responsible for.

from £20,000

Liability cover

Covers your legal liability for accidental death, injury or illness to someone else, or damage to their property.

up to £5 million

Personal possessions

Cover for portable items that you take out of your home, like bags, clothes and sports equipment

Optional

(excluded if you have paying guests)

Gadgets, bikes and valuables away from the home

Cover for electronic gadgets (e.g. mobile phones, laptops, tablets etc), bikes (including electrically assisted bikes) and valuables (e.g. watches and jewellery) that you take out of your home.

Optional

(excluded if you have paying guests)

Accidental damage

Covers situations when unexpected accidents happen, such as spillages on the carpet, breakages around the house or drilling through hidden pipes. Two levels of cover are available.

Optional

(excluded if you have paying guests)

Optional extras

Policy add-ons are available for greater protection, such as Accidental Damage, Home Emergency, and Legal Expenses.

Some covers, such as Accidental Damage, are not available when the property is let to paying guests.

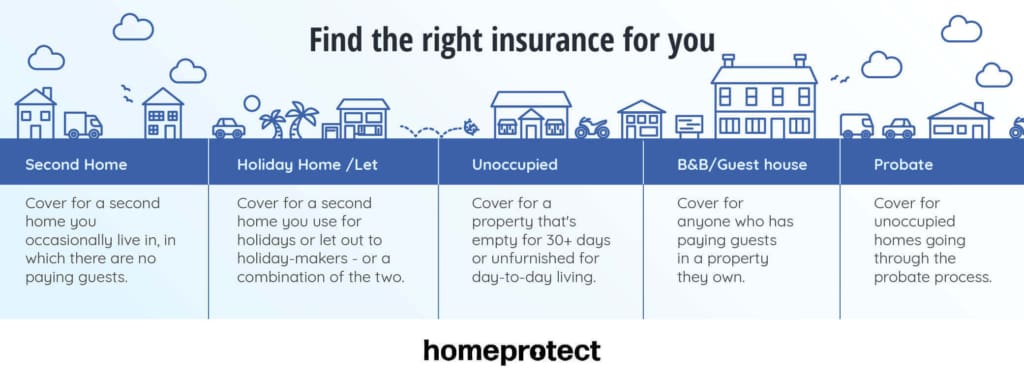

Property use types

Second Home Insurance is available whether your property is for private use only (e.g. your holiday getaway), or if you let it out to guests (short-term or long-term) as a Holiday Let. If you do let your property out to guests, full disclosure to your insurer is required.

Please note that this type of policy will not cover main residences, high value, commercial, or multi-occupancy properties.

Keeping your property safe

To keep your cover valid, you may be required to maintain appropriate security measures. This includes fitting quality locks, using a burglar alarm while the home is unattended, and securing all windows and outbuildings. When the property is left empty for an extended period, additional precautions may be needed, such as regular checks. Failure to follow these precautions could affect your cover, especially for theft or damage claims. Check your policy for specific security requirements.

Other key tips include:

- Turning off all electrical appliances. Turn off the electrical and water supplies to the property completely if it will be unoccupied for a long period of time.

- Invest in additional security measures such as safes, smart locks, and cameras.

For more information, read our Guide on Leaving Your Property Empty.

New Customer?

If you’re deciding on whether to buy home insurance with us, you can use our latest policy booklets as a guide.

Existing Customer?

Find answers to some of your questions here. Your latest policy documents are also available to view and download.

What our expert says…

“We currently insure over 40,000 second homes. Our cover is designed to reflect the unique risks of second homes, and there may be additional restrictions or conditions compared to standard policies. Maintaining security, arranging regular property checks, and keeping the home well looked after are sensible ways to reduce the risk of problems – though specific policy requirements apply only in certain circumstances.

If your property use changes – for example, if it becomes your main residence or is let to guests – please let us know so we can ensure your policy remains appropriate for your needs.”

Frequently Asked Questions

You can rent your second home to paying guests, but you may need additional cover or a specific policy for holiday letting or short-term rentals. Please let us know how you plan to use your property so we can ensure your insurance provides the right protection.

Yes – if your property is unoccupied for more than 30 days, you must arrange and evidence internal inspections at least every 30 days, to keep full cover in place. If you don’t, some cover – especially water damage in winter – may be restricted or excluded.

Second homes require special consideration, as they can be left empty for long periods, increasing risks like leaks, break-ins, or storm damage going undetected. Because insurance for second homes is not as widely available as standard home cover, Homeprotect has tailored its cover for these situations.

You might also be interested in…

Stamp Duty on second homes

Looking to buy a home and need help calculating how much Stamp Duty you’ll need to pay? Use our helpful Stamp Duty calculator below:

Stamp Duty you will pay:

The effective tax rate is 0%.

Calculate how much Stamp Duty you will pay

This stamp duty calculator provides an indicator of the tax due if you buy a residential property. You should always use a property professional for complex transactions.

Our stamp duty figures only apply to England & Northern Ireland. Scotland & Wales have different rules. Our assumptions are:

- You are buying a property with fixed foundations (e.g. not a caravan, mobile home or houseboat).

- There aren’t multiple properties in the transaction.

- The purchase will be made by an individual, married couple or civil partners not by an organisation, or group of unpartnered people.

- That this is not new leasehold property with a large annual rent e.g £4,500 a year for a 99 year lease.

Your Questions Answered

Yes. Each property needs its own policy, and we tailor cover based on how the second home is used. Depending on your situation, Homeprotect provides second home insurance for rental properties, second home insurance for holiday homes, and second home insurance for homes left unoccupied.

You’ll need to know your property’s rebuild cost (which you can calculate in our online quote journey), year of construction, any history of subsidence or flooding, and the value of contents to be insured.

Most mortgage lenders insist that homeowners have adequate second home buildings insurance in place. It is also generally recommended that you have contents insurance to protect your belongings. In the event of a loss or damage, contents insurance can help to cover the cost of repair or replacement. This is a worthwhile investment if you are letting your second home to paying guests.

Only if you can prove an insurable interest. Contact our team to discuss your situation.

It’s the home you live in most of the time, where your legal documents are registered, and where you keep most of your belongings.

It can be, depending on how the property is used, how secure it is, and how long it’s left unoccupied.

Tell us if your property will be empty for more than 30 consecutive days. We’ll adjust your policy to reflect the increased risk and keep your cover valid.

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.