Types of door & WIndow locks

What you need to know about house locks

When it comes to protecting your home, door and window locks are some of the most basic necessities to have. As well as burglar alarms and security systems, your property should be protected with insurance approved locks.

Types of house locks can impact your insurance hugely. If you fail to properly declare which locks are in place at your property and need to claim later down the line, you may well find that your policy is invalid. This is why we specify the types of window locks and door locks for homes that need to be in place to provide adequate cover.

Types of door locks for homes

What type of lock should be used for the main entrance?

A 5 lever mortice deadlock conforming to British Standard BS3621 or a key operated multi-point lock system or a rim automatic deadlatch with a key locking handle.

What type of lock should be used for patio doors?

A top and bottom key operated lock or a central rail key operated lock or a key operated multi-point lock system.

What other types of door locks are there?

A 5 lever mortice deadlock conforming to British Standard BS3621 or a key operated multi-point lock system or a rim automatic deadlatch with a key locking handle or key operated security bolts at top and bottom.

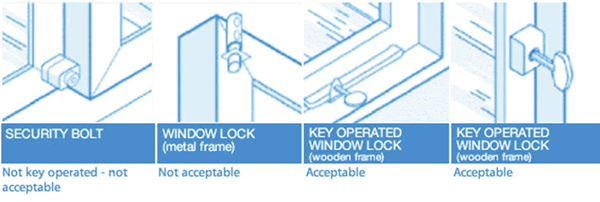

Types of window locks for homes

What type of lock should be used for the windows?

Key operated window locks should be on all ground floor and accessible windows.

Delve into the detail

- What’s covered, what’s not.

- How to purchase.

- How to claim.

- What excesses will be payable.

Get a home insurance quote online

Get a quote online in less than 10 minutes*

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.