House of Horrors: The Scary Things Putting UK Homeowners Off Buying a House

With Halloween just around the corner, many will be celebrating spooky season by embracing all the things that go bump in the night.

But while 64% of Brits believe in ghosts, the reality of them being in your home is somewhat less desirable. In fact, research shows that a property that is haunted or has a chequered past can be devalued by up to 20%.

According to our recent survey, Brits are so averse to the idea of ghosts and strange happenings that nearly 25% would be put off buying a house if it was rumoured to be haunted. But for others, more practical hazards are a major dealbreaker when it comes to home buying.

Let’s look at how concerns about haunted or problematic houses shift depending on the age or location of the buyer.

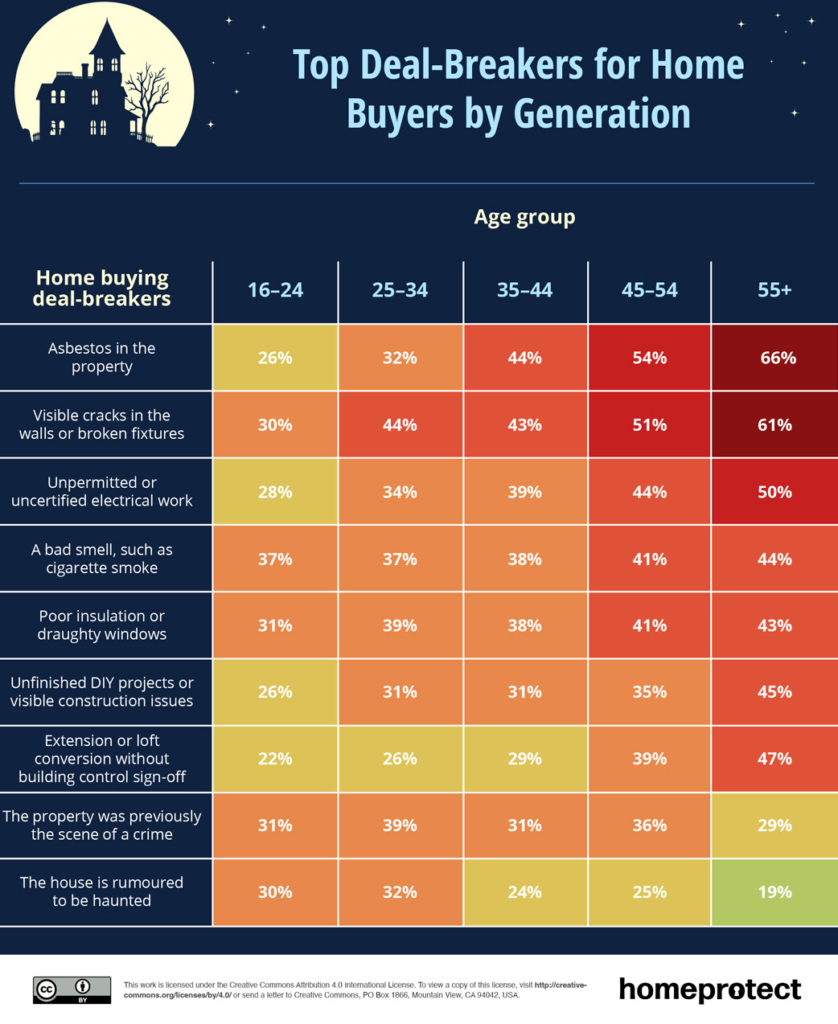

Young homebuyers: most concerned by haunted houses and crime scene properties

Houses that are rumoured to be haunted are a top home buying concern for 30% of 16–24-year-olds and 32% of people aged 25-34.

And for nearly 40% of 25-34-year-olds and 31% of 16-24-year-olds, a house that has previously been the scene of a crime is a deal-breaker.

Older homebuyers: more concerned about physical hazards

Not everyone fears ghostly happenings. Our survey reveals that older generations are more spooked by purchasing a home with material issues, such as asbestos, visible cracks in walls or broken fixtures, or unpermitted or uncertified electrical work.

Less than one in five (19%) of those aged 55 and up are worried about living in a haunted house.

Asbestos is a primary concern for people aged 35-44 (44%), 45-44 (54%), and 55+ (66%). Yet only 26% of 16-24-year-olds and 32% of 25-34-year-olds are concerned about asbestos.

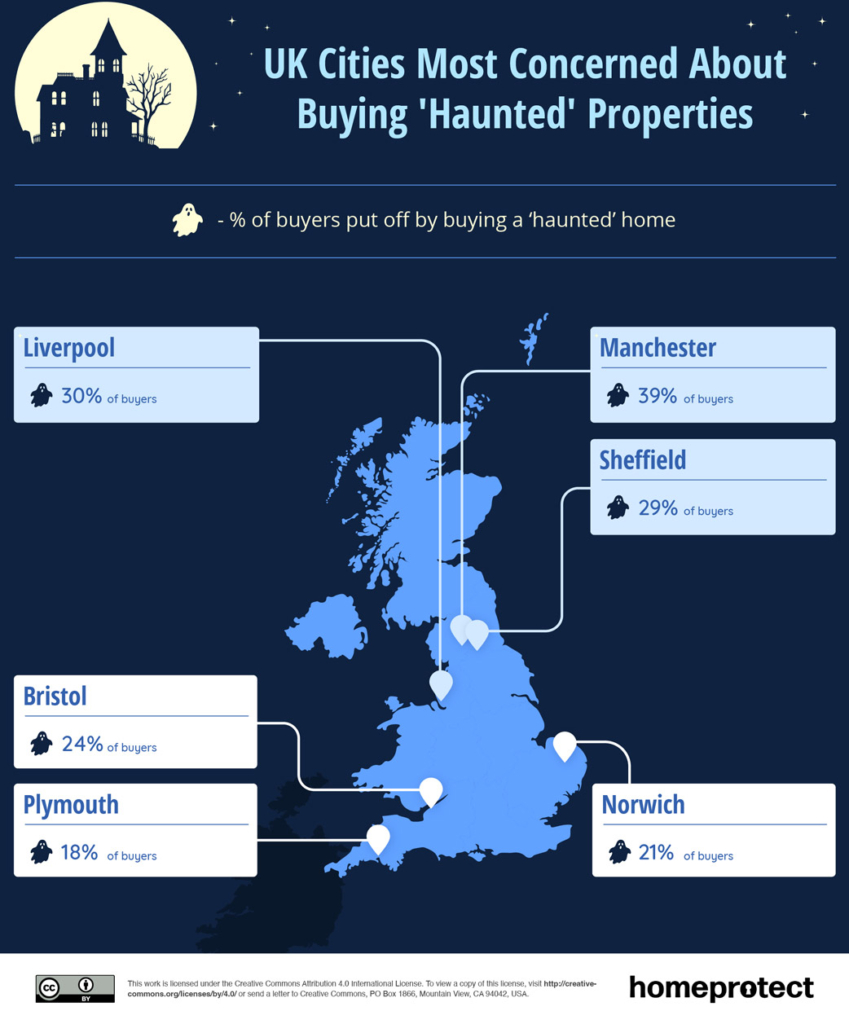

Buyers in northern cities are most likely to avoid stigmatised properties

Interestingly, our survey data reveals a north/south divide between those who fear haunted or crime scene properties most and those who would avoid those with physical issues.

This was particularly a top concern for nearly a third of people living in northern cities, such as Liverpool (30%), Manchester, and Sheffield (both 29%).

But as you travel further south, spooky issues are much lower down the list of home-buying issues, and the aversion to real hazards is much greater.

Norwich residents are most against buying a house with asbestos (65%), visible cracks or broken fixtures (63%), and unpermitted electrical work (53%).

Other cities, such as Southampton and Bristol, show similar preferences for turn-key properties with no visible defects.

The real scare factors potential buyers should look out for

While hauntings and crime scenes are disturbing, it’s important to interrogate the practical concerns potential homebuyers should be taking into consideration.

The top 5 concerns overall for the UK are:

- Asbestos in the property – 50%

- Visible cracks in the walls or broken fixtures – 50%

- Unpermitted or uncertified electrical work – 42%

- A bad smell, such as cigarette smoke – 41%

- Poor insulation or draughty windows – 40%

It’s worth knowing that new building regulations don’t allow asbestos. Many existing structures have it and it is generally safe as long as it is not disturbed or damaged, but it would need to be removed if any renovation works were undertaken. Asbestos removal requires a specialist, so this will add to your renovation costs.

Meanwhile, visible cracks in the walls or broken fixtures could be a sign of subsidence. Buyers should take precautions and get a professional survey completed before buying to assess the cracks and check for structural issues.

Additionally, purchasing a home with unpermitted or faulty electrical work, or poor insulation, will likely make the purchase harder and may require an indemnity policy.

At Homeprotect, we know buying a house can be scary enough as it is without adding possible hauntings to the mix. With our new Home Risk Calculator, which is free to use, users can identify various risks for their property, along with practical tips and advice on how to look after their property.

Amidst the spooky season and property concerns, there are also timely seasonal threats to consider. Storm season in the UK, which typically starts in October, brings its own set of worries. Here are our top five storm preparedness tips to help keep you and your property safe.

#1 Tick off outdoor maintenance tasks

At the start of Autumn, your gutters and drains could be filled with debris like loose leaves, moss and twigs. Clearing this before the weather turns should help prevent potential blockages, which could cause leaks, flooding, or even damp in your home if it seeps into your walls. It’s also sensible to trim back any tree branches that could cause damage if they were to fall in windy conditions.

It’s a good idea to get your roof inspected by a qualified roofer (usually accredited by TrustMark, RoofCERT, National Federation of Roofing Contractors, National Federation of Builders or Federation of Master Builders) and ask them to check for any cracked or loose roof tiling and any displaced bricks around the chimney. This is particularly important for homes or garages with flat roofs, as high winds can lift felt and tiles easily.

#2 Secure windows and entryways

You don’t want a storm to be the thing that uncovers a leak or problems with the sealants around your doors and windows.

Check your entryways closely to check the sealant is secure and not eroding. Poorly sealed entryways could allow water to seep through into your home and have long-term consequences such as water damage, dampness, mould or even lead to a loss of heat, which would likely increase energy costs.

Silicone sealant can be tricky to apply and remove, so call in a professional for help.

#3 Secure your garden and exterior

Intense winds, a common feature of storms, can cause tree branches to break easily, debris to move, or fences to fall – which can cause damage to your and your neighbour’s property.

If a storm is forecast, check the exterior of your property for any issues and ensure everything is secure, including parking your car in a garage and securing any garden furniture or objects, such as trampolines, that could be blown away.

#4 How to make claiming after a storm less scary

Before submitting a claim, it is important to read through your home insurance policy and check what is and isn’t covered.

For example, garden fences are commonly damaged in a storm, but they are often not covered by home insurance.

If something’s been damaged but it isn’t covered, avoid submitting a formal claim, as rejected claims remain on file and may impact future insurance premiums.

You should also check the excess on your policy, as the voluntary excess may be higher than the value of what you’d be claiming for.

#5 What to do once the storm has passed

It’s important to visually inspect your home for damage. Home emergency cover can help in some situations while you submit a claim, so it’s worth checking if you have this within your policy – for example, for water ingress (where water gets into your property).

Other forms of damage, such as loose or broken tiles, will need to be fixed once a storm has passed.

Be aware that a claim may be rejected if your insurer discovers that any damage is due to unaddressed wear and tear that made it particularly vulnerable to storm conditions.

Methodology

The survey was conducted by Censuswide on behalf of Homeprotect, with 2,000 adults in the UK in December 2024.