Flood Risk Home Insurance

Quick to buy online

- We support and offer Flood Re.

- All types of flood risk (coastal, flood plain).

- Previous flood history considered.

- Underwritten by AXA Insurance.

More information

Home insurance for flood risk areas

Thousands of UK properties are at risk of flooding. To continue to offer UK residents affordable flood risk home insurance, Homeprotect is working in partnership with Flood Re. This government-backed scheme allows us to cover more properties and provide home insurance for flood risk areas.

Getting an online quote is easy too. We do the hard work for you, including working out your Flood Re eligibility. So, you can rest easy knowing that you’ve got the most affordable flood home insurance to protect your property. All in a matter of minutes!

What is flood insurance?

Flood home insurance is a type of building insurance that covers a home and its contents against costs incurred as a result of water damage caused by flooding in the case of bad weather, high tide or burst river banks.

Do I need flood insurance?

Homeowners sign up for home insurance with flood cover to ensure they’re protected in the case of damage to their home and belongings. If you live in a high-risk area, you may be required to flood-proof your home in order to be insured or to avoid a higher premium or excess cost. If your property has a history of flooding, you must inform your insurance provider of this.

What does flood insurance cover?

Flood insurance covers the cost of removing debris, as well as the repair or replacement of damaged furniture, belongings, fittings and fixtures. It can also cover the cost of alternative accommodation if you cannot live in your home due to the flood damage.

Examples of things in the home that can be covered are the foundation of your property, electrical and plumbing systems, kitchen appliances, carpeting, furniture, clothing, electronics and more.

Who is eligible for flood re?

Being able to purchase a policy with Flood Re cover is dependent on meeting certain defined criteria. If your home or situation falls outside of these criteria, you won’t be able to take advantage of Flood Re. However, Homeprotect can still cover your home and belongings with our buildings policy, sometimes even with flood cover included. Start by getting a quote online to see if we can cover you.

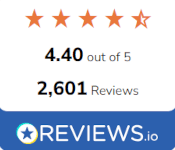

flood risk Home Insurance Reviews

Get a home insurance quote online

Get a quote online in less than 10 minutes*

What’s covered by home insurance?

Home insurance provides financial protection if you need to repair your home or replace your belongings after they’ve been stolen, damaged or destroyed.

It comes in two parts: buildings insurance (cover against damage to the property itself) and contents insurance (for damaged or stolen items within the home). These can be combined or bought separately, so the first step is deciding which option is better for you.

What we offer

Quick home emergency response times

Have a home emergency, such as electricity failure, faulty locks or vermin infestation? With the 24/7 Home Emergency cover, which we provide as standard, you can typically get an engineer at your home within four hours. And if you’re worried about an uncontrollable leak in your home, we aim to have an emergency plumber to you within two hours.

Extreme weather conditions may extend response time. Policy terms and claim limits apply.

5 star rated buildings cover

Our building insurance has been given the highest rating by independent financial research companies, Defaqto and Moneyfacts.

Repair guarantee

Any buildings work we undertake is guaranteed for 24 months following a claim and any contents repair work we undertake is guaranteed for 12 months.

New for old

Where we replace an item, we will do our best to meet the original specification on a ‘new for old’ basis. If we can’t find an exact replacement, we’ll offer you a suitable alternative, or a full cash settlement.

Legal advice

We provide Legal Protection cover as standard, giving you access to telephone legal advice on any personal legal issue, under the laws of the UK, any European Union country, the Isle of Man, Channel Islands, Switzerland and Norway.

What isn’t included?

Damage cause gradually, or by wear and tear, or by failure to fix a known issue.

Faulty design or poor workmanship.

Flood damage to outdoor fuel tanks, hot tubs, swimming pools, tennis courts, walls, gates, or fences (unless the main home is also affected at the same time).

The cost of repairing or replacing items following a mechanical or electrical fault.

Lost items.

high flood risk home Insurance Cover Levels

Our home insurance is designed to protect your home against insured events such as fire, storm, flood, escape of water, theft, malicious damage, subsidence, landslip or heave. Where possible, it is also designed to protect against flood.

Flood cover by flood re

Most customers in a property at a high risk of flooding will qualify for flood cover via Flood Re – a government initiative designed to lower the cost of insurance for properties in flood risk areas. The use of Flood Re has no impact on the way we manage your policy, so you’ll still speak with us to make policy changes or to submit a claim. In the event of a valid flood claim, we’ll work directly with Flood Re to make sure your property is restored and put back to normal.

Flood cover by homeprotect

In the event that your property does not qualify for Flood Re then we may still be able to provide flood protection ourselves – although this would likely mean a higher excess would apply in the event of a valid claim.

home insurance excluding flood cover

There may be circumstances where your property doesn’t qualify for Flood Re nor are we able to provide flood protection. In which case, we can still offer home insurance to protect against other insured events (such as fire, storm, escape of water, theft, malicious damage, subsidence, landslip or heave).

Buildings cover

Covers the main structure of your home if you need to rebuild or repair it.

up to £1 million

(eligibility criteria applies)

Contents cover

Covering the value of all your possessions in the home, on a new for old basis.

from £25,000

Alternative accommodation

For you and your pets, in case you can’t live at your home while it’s being repaired after an insured event.

up to £85,000

Home emergency

Covers emergencies that occur in your home like uncontrollable water leaks, electricity failure, faulty locks and vermin infestation. Two levels of cover are available.

up to £500

Family legal protection

Provides a 24/7 legal advice helpline and up to £25,000 cover for claims involving contract disputes and property damage. For a claim to be successful, there must be reasonable prospects (more than a 50% chance) of winning the legal case. Two levels of cover are available.

up to £25,000

Trace and access

Covers the cost of detecting the source of a water or oil leak and repairing any damage caused in the process.

up to £10,000

Outbuildings cover

Covers rebuild or repair of your outbuildings (such as detached garages, greenhouses, sheds and summerhouses).

from £20,000

Liability cover

Liability cover involving accidental death, bodily injury or illness or property damage that you are legally liable to pay.

up to £5 million

Personal possessions

Cover for portable items that you take out of your home, like bags, clothes and sports equipment

Optional

Gadgets, bikes and valuables away from the home

Cover for electronic gadgets (e.g. mobile phones, laptops, tablets etc), bikes (including electrically assisted bikes) and valuables (e.g. watches and jewellery) that you take out of your home.

Optional

Accidental damage

Covers situations when unexpected accidents happen, such as spillages on the carpet, breakages around the house or drilling through hidden pipes. Two levels of cover are available.

Optional

New Customer?

If you’re deciding on whether to buy home insurance with us, you can use our latest policy booklets as a guide.

Existing Customer?

Find answers to some of your questions here. Your latest policy documents are also available to view and download.

flood insurance with Flood Re

Homeprotect was one of the first UK home insurance providers to offer flood insurance as part of Flood Re.

Your Questions Answered

There may be exclusions stated in your policy and it’s very important that you read and understand these exclusions. Examples of things that may not be covered are basements and their contents, as well as items such as money, precious metal and important paperwork kept in the house.

It is worth knowing if you live in a flood risk area in order to make an informed decision about flood risk home insurance and how much cover you need. You can find this information free and instantly online, by entering your property’s postcode into the Government’s flood risk assessment page.

A full flood risk assessment is only worth paying for if you are thinking of developing your property. If you are entering a planning application for your property and live in a flood risk zone, you need to complete a flood risk assessment as part of your application. These kinds of assessments explore the probability of a flood at a specific location, the possible causes of floods in the area and advice on managing flood risk.

For homes in England, this can be done instantly and for free simply by entering property’s postcode and house number on the Government’s long term flood risk assessment page which also includes links to flood risk information and maps for Wales, Scotland and Northern Ireland. This tells you how likely it is that the specific location is to flood in the future, and the factors that could cause or contribute to flooding there, as well as where to get information on preparing for a flood and how to sign up for flood warnings.

The Government portal also provides a map where you can enter your postcode to see a map showing the flood risk from rivers or the sea, or the flood risk from surface water. Use it’s ‘detailed view’ option to see depth, flow speed and flow direction estimates.

Flood Re is a flood risk home insurance scheme, designed to make flood cover more affordable for UK homeowners which has been in place since 4 April 2016.

The Flood Re scheme enables insurers to take on more customers at risk of flooding because the consequences of large claims are shared between insurers. This happens behind the scenes, so customers can compare and purchase home insurance as they would normally.

- Properties must be located within the UK mainland.

- Properties must have a Council Tax band A to H.

- Properties must be built before 1st January 2009. Note: If a property has been demolished and rebuilt before this date, then the new building is still eligible for Flood Re.

- Properties must be used for residential purposes.

- Properties must have an individual premium.

- Leasehold flats with three or less fewer units are eligible.

- The policy holder or their immediate family must live in the home for some or all of the time, or the property must be unoccupied.

- The insurance contract must be in the name of one or more individuals, not companies.

You can find the full eligibility criteria on the Flood Re website.

- Bed and breakfast premises that are paying business rates.

- Contingent buildings policies, such as those held by banks.

- Farm outbuildings.

- Freeholders/leaseholders deriving commercial income by insuring large numbers of properties for a portfolio.

- Housing association’s residential properties.

- Multi-use properties under commercial or private ownership.

- Residential ‘buy to let’ properties that do not meet the criteria specified above.

- Static caravan site owners when they are being used for commercial gain.

- In the case of blocks of residential flats, company houses/flats, and social housing contents only can be covered.

The good news is that the actual transfer of the flood risk element of your policy to Flood Re is done in the background by your insurer. When it comes to working out your eligibility for the scheme, Homeprotect will calculate this for you automatically.

We want to make this process as hassle-free as possible, so we’ll return an individual quote that is specific to your property and we will identify whether you are eligible for Flood Re in a matter of minutes.

There are several online resources which you can visit to get more information on flood risk in your area, namely:

- Flood Free Homes wants all UK houses to be free of risk by 2025.

- National Flood Forum provides support and advice to communities or individuals that have been flooded.

- Know Your Flood Risk works to raise awareness of the risk of flooding from all sources, not just a visible water course such as rivers and seas.

This depends on a large number of factors including how widespread the flood was, how severe the damage caused was, and how many properties were affected is the first variable. After a major flood event, insurance companies often take on additional loss adjusters, but even so the time it can take for you to be visited by one can be longer than you’d like.

Cleaning and drying operations can take many weeks or months depending on the availability of services and how greatly your property has been affected, as well as what your home is made of.

Finally, reinstatement works themselves are also time-consuming. The process of choosing replacement furniture, decoration and fitted units (which you may have originally selected over the course of years) takes time, especially if you are working and have little time to shop around, and then you need to wait for delivery and fitting.

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.